I think it's worth noting that I think Groupon is a brilliant idea. I'm an avid customer. I signed up for the service in November of 2008, which was the same month as the launch. I think management is smart, I think their customer service is great, and I think the company has a great culture.

However, as of the close of business today, the market cap for GRPN is $15.04 B on revenues of $1.29 B and net income of $-686 MM.

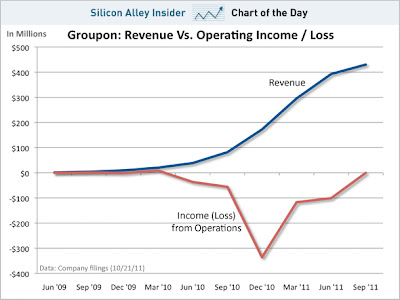

Now, if you don't value stocks often, you may not realize how grossly out of whack that is. They have a year-over-year revenue growth number of 426%. That is flat out awesome. No doubt about that. However, it is plain to see from the chart below, that that revenue growth next year will be WAY lower. A rough extrapolation of the line would project something in the range of 100%-200%. Still great growth, but less than half of the current rate.

Certainly the company is flush with IPO cash and may use it for aggressive growth into new markets, like Brazil and China. So perhaps for another year or so, the company can keep revenue growth in the triple digits. But even that is a stretch to me.

Marketing dollars (no matter how much) won't be able to drive growth at that rate for long. It is simply too easy to to copy the business model. We have already seen a litany of "daily deal" copycats sites show up (Living Social, KGB Deals, ScoutMob). More problematically, legacy sites with lots of traffic, and long-lasting customer relationships are also getting into the daily deal business. Newspaper sites, eBay, and online retailers are the biggest threats to Groupon's business model. If they haven't launched them already, thousands of websites are trying to figure out how to launch daily deal services in the next year.

To use the language of the perhaps the most sensible billionaire, the "moat" around Groupon simply isn't wide enough. The brand is great, the customer value proposition is great. But at the end of the day, it will be very difficult for Groupon to grow into it's current valuation.

Even in the dot-com bubble, it was irresponsible to pay more that 10X revenues for companies. Calculating values was very hard, since nearly none of them had earnings, and sometimes even revenues were hard to come by. As an illustration of the absurdity, people tried valuing companies based on eyeballs when there was no revenue to value.

This brings us back to the current value of GRPN. $16 B is 11X revenue and some gigantic multiple of future (not yet real) earnings. There is a rule of thumb that you company is worth an earnings multiple equal to the earnings growth rate. GRPN has a multiple of 168X next years projected revenues. That looks pretty good if you think that growth is 426%, but a year from now, that number will look more like 100% and that won't translate well at all.

This valuation multiple is simply too high for a company that is already showing signs of slowing revenue growth. Of course, next year's revenues promise to be AMAZING, because the company will probably spend hundreds of millions on advertising. But that will come at a huge cost to profit margins, which are already negative.

This valuation multiple is simply too high for a company that is already showing signs of slowing revenue growth. Of course, next year's revenues promise to be AMAZING, because the company will probably spend hundreds of millions on advertising. But that will come at a huge cost to profit margins, which are already negative.

That said, it is worth noting that Groupon's model is a pre-paid model, and so the company will benefit from the carry interest on all those groupons being sold. Here, people buy groupons and pay on the spot. Groupon doesn't pay any money to the merchant until people actually use the groupons. So, Groupon collects interest on all that money in the meantime. Also, they will get to keep some percentage of the money spent on groupons that expire unused. I expect that at some point in the future, there will be a class action law suit filed by Groupon merchants (or States Attorneys General) to reclaim some of the money spent on Groupons, but never redeemed. The legal question being whether a Groupon is a gift card or a coupon. So far, there has been no ruling, but there will be one day, I'm certain of it.

So a responsible investment analyst would make some projection of Groupon's revenues and apply some sort of discounted present value. But the Market Monkey is not here to do math for you. He is here simply to say that Groupon is great, but not at all worth $16 B.

MONKEY BUSINESS:

Shorting: GRPN @ $24.51

Buying: AGQ @ $54.10, AVL @ $2.72, NFLX @ $74.70

Holding: AGQ ($79.85, $63.16), UGL @ $91.00

Holding: AGQ ($79.85, $63.16), UGL @ $91.00

No comments:

Post a Comment