It is worth noting that while Buffet's marginal tax rate is lower than this secretary's -- it should not be misunderstood: He DEFINITELY does not pay fewer dollars in taxes than his secretary (in a typical year). It probably also worth noting that he COULD. If he elected to not pay himself any dividends or paychecks, I expect Mr Buffet could pay $0 in income tax any given year if he chose to do so.

Anyway, let look at this more broadly than just one billionaire and his secretary. The chart below shows the distribution of US tax payers by income percentiles, their share of income, and their share of taxes paid.

Chart: Heritage Foundation via Zero Hedge

We can see that the Top 10% of earners, earn 43% of the income and pay 71% of all of the individual income tax. In contrast, the bottom 50% of earners collectively earn on 13% of the income and pay only 2% of all the income tax.

Some may see the tax burden of the Top 10% as unjust, others will see their disproportionate share of the income as even more severe sign of injustice.

Who is paying their "fair share"? The chart above doesn't necessarily give us an answer to that question. It's in part, a moral values question. One possible place to look for answers would be to compare that distribution to other leading OECD countries, or perhaps compare it to past distributions in US history. I think both of those are worth exploring.

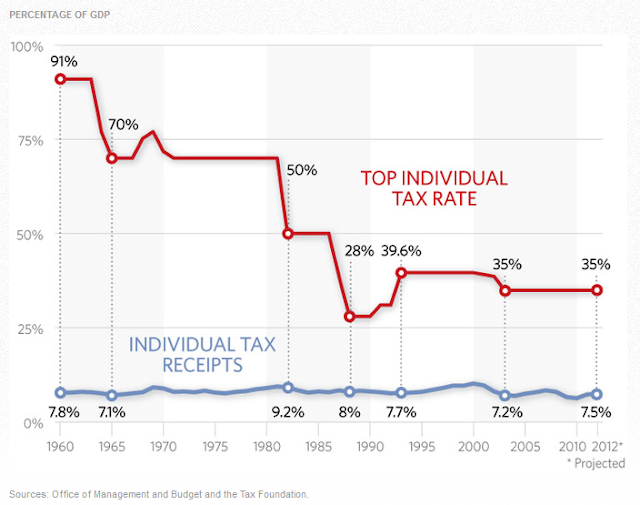

Key to the policy debate is "What should the top marginal tax rate be?" The chart below provides some context to the debate, as the top tax rate has fallen from 91% in 1960 to the mid-30% that we have today. Of course, the top tax rate is a dynamic and vague question.

The top rate needs to be taken into consideration with the brackets, the rate applied to all other brackets, and what types of deductions, credits, and caps are allowed.

This is where the Warren Buffet issue comes into play. He earns in the top tax bracket, but doesn't pay nearly 35% in taxes. He has publicly stated that his effective rate is 15.4%. So it appears that "Top Marginal Tax Rates" don't necessarily effect the top earners nearly as much as we expect. Perhaps professional athletes and movie stars are affected, but all of the hedge fund millionaires and business owners (small and large) have much more control over when and how their income is applied. Often their choices are how and when to realize their income will be driven by tax code. However, I laugh-out-loud at the notion that people will stop trying to get rich if the tax rates on the Top 1% are raised. John Paul Getty wasn't exactly deterred by high taxes -- and he made his billions when the top rate was 90%.

Chart: Heritage Foundation via Zero Hedge

The chart above shows that there is no visible correlation between the top marginal tax rate and the total amount of income tax paid. Of course, as mentioned above, we have no idea what counter balancing factors were going on in the tax code from this chart. All we can say for sure is that it looks like Uncle Sam collects around 8% of GDP each year as tax revenue. So perhaps the answer for increasing revenues (and closing the deficit) is less related to the tax code and more related to raising GDP.

Food for thought in this election year.

No comments:

Post a Comment