The wide ride for the price of Bitcoin over the last few months has been very fun to watch. Over the last six months, the digital currency has experienced a parabolic run from the $17 to $263 and a subsequent crash back to $50. As you can see, the price has recovered somewhat in the last week and is now trading around $120.

Bitcoin is an all-digital currency which is widely used for anonymous transactions over the internet. As such it is a common means for payment for all-digital goods in video games and also for illegal drugs also traded over the internet. Prior to March 16, 2013 that was basically all it was used for. Then the world changed for Bitcoin (and nearly all bitcoin holders).

It is certainly possible that it is a coincidence, or a planned maneuver by some shrewd market manipulators in Bitcoin. But the simple story is this: On March 16, the ECB announced a bail-out plan for the Cyprus banking system that involved a 40% haircut of all deposits over 100,000 EUR (roughly $130,000) in order to fund the bail-out. Obviously, this set off a panic in the Crypiot community. The bank run was mitigated by a week long bank holiday, followed by restrictions on daily withdrawals in Cyprus. This also seemed to set off a interest in holding money outside of the Euro and outside of a bank.

Enter, the massive appreciation of value of Bitcoin (BTC).

Now, I don't want to voice a prediction on whether or not BTC is a good store of value or not. But what I think is particularly interesting here is that its very easy to apply the most common economic model to our situation. The basic supply and demand curve:

A standard market for a good has a sloped demand curve and supply curve. As you remember, as a product gets less expensive, more customers will want it and fewer suppliers will be willing to sell it at that price. Conversely, as a price gets more expensive, fewer customers will want to buy it and there will be ample suppliers willing to sell it at the higher prices. In a normal market, especially a capital market which is especially liquid, the supply and demand curves will respond to price actions and work to moderate the drastic movement of prices.

Bitcoin is a very interesting case though. Because the supply of Bitcoin is fundamentally governed by a digital algorithm, the supply in the long run is entirely inelastic. The inelastic nature of the market is visualized in the near vertical supply curve above. In some ways, the supply is fairly inelastic in the short run as well, because only a small number of Bitcoin are produced a day -- and the algorithm is designed to make it harder and harder (read more computing hours) to produce a bitcoin as there are more Bitcoin in existence. So, holders of existing Bitcoin are the only suppliers that provide any tilt to the supply curve at all.

So, as a small segment of the European banking system sets into a crisis, the demand for Bitcoin as an alternative haven pushes the demand curve upward (from Demand 1 to Demand 2). Because the supply curve can't react, the price moves dramatically. This doesn't predict that prices will go up sharply, as much as it just predicts that price movements are almost entirely driven my demand changes at this early stage in Bitcoin's liquidity maturity.

Certainly, all capital markets function in a somewhat restricted supply in the short run. There won't be more Amazon.com stock tomorrow, just because the price goes up today. And certainly there is only a fixed and predictable amount of oil or copper coming out of the ground any given day. However in the long run most things do face some curve, where if the price goes up enough Amazon will certainly issue more stock or more people will get into the business of digging for oil and copper. So in the short run, it's about incumbent holders of a commodity selling into the market.

Its in this newness of Bitcoin going from fringe payment mechanism to semi-legitimate capital market where the supply curve hasn't really figured out how to respond, and is shocked into an inelastic state. I would expect that it will take about 6 months for the turnover in bitcoin to get into the hand of enough traders for the short-run supply curve to long like a fairly normal market. However, until then... and then some point soon after Bitcoin will again feature the near vertical supply curve that drove the radical price movements of the last month.

The Market Monkey

Friday, April 19, 2013

The Economics of Bitcoin

Labels:

bank,

Bitcoin,

BTC,

crisis,

Crypus,

currency,

demand curve,

economics,

supply curve

Tuesday, April 16, 2013

What Next for Gold and Silver?

On Friday morning there was impressive sell-off for precious metals, leading to a two day decline that was the largest in 30 years. Gold fell from 1552 to 1325 and Silver fell from 27.60 to 22.10, a 14.6% and 19.9% drop in the course of two days.

As I write this, midway though day 3, prices have stabilized a bit, recovering about 1/5 of what was lost on Friday and Monday.

ZeroHedge points out the recent move for Gold was a 7-sigma event. Assuming a normal distribution, that means there is a 0.0000019% chance of an week like this occurring given the price action over the last ten years.

So, what on earth is happening?

The most common story that we've heard is that a massive sell order of 4 million ounces hit the market at the open of US trading, routed through the Merrill desk. So whoever it was that was selling was clearly trying to move the market -- as you would take an entirely different approach if you trying to unload that much at a decent price. That massive trade was approximately $6 B worth of futures, which took approximately $1 B of initial margin to start (if it was new position). Over the morning, over 400 tonnes were traded which is equal to 15% of the annual production of gold. What happened over the weekend and on Monday is that margin calls brought substantial pressure on the precious metals market.

It didn't help that given the price volatility, both the Shanghai Gold Exchange and CME raised margin requirements by 15%+ on Sunday and Monday. This, as you would expect, put additional pressure on metals prices due to market participants needing to pear back positions to meet margin requirements.

It's a little bit surprising that how much effect that a $1B trade can have on a such a liquid market like gold.

So what's next?

My gut feeling is that the $1B shot on Friday was guns blazing and that whoever threw that wrench into the system is spent. I would imagine that any follow-on attempts would be less impactful, since the marginal hands have been emptied. I believe this to be a local bottom for the metals.

Saturday, August 18, 2012

Why the next 30 years will kind of suck.

At a dinner party a few days ago, I was trying to explain what the sovereign debt crisis meant to average people and why it kind of sucks to be someone who is just starting their working career today. I hadn't used this analogy before, but might be pretty appropriate.

Imagine you and a few friends are driving a car really far. Not just across the country, but back and fourth across the country forever, until there is no more country. This road trip has to last as long as there is still a country. You have this magic kind of car that produces gasoline for itself, but it doesn't produce quite enough gas on its own to go very fast. Say it can typically support the car going 25 miles per hour.

So, as long as you and everyone in the car decide that 25 miles per hour is fine then you will able to drive forever. Of course, it would be way more fun to go 80 if you could, right? Well, a few years ago the drivers of the car made a deal with a gas station that will give you a bunch of gas for free, if you agree to give all that gas back in the future with a little extra. Of course, just like you, those drivers wanted to go fast, so they signed up for the deal. They filled the tank to the brim and took off! Zoom, zoom! Now, it's 30 years later and everyone has gotten used to driving at 60 miles an hour.

Today, the folks that have enjoyed riding in the car for the last 30 years are retiring and handing the keys over to the next set of drivers. But after decades of speed, the gas tank is now completely empty. Thankfully, the magic car still produces enough gas to naturally let us cruise at 25, which would be fine. But the gas station that lent us all that gas back when is demanding that we pay back the gas that was borrowed. So, it siphons off 10 MPH worth of gas as we drive. Now our car can only go 15 miles an hour. Compared to 60, that kind of sucks.

The sovereign debt crisis is the collective set of all cars slowing down. Everyone has run out of this extra, borrowed gasoline. If you are 60 or older, you got the chance to spend most of your working career in a car zipping along at high speeds. For younger workers, this new pace of 15 is going to feel really slow compared to years past. If you are just starting your career here, welcome to a period of suck. It may not be 15 miles an hour forever, but it's very unlikely that you'll get to see 60 MPH in your working years.

Saturday, May 5, 2012

What is a Fair Share of Taxes?

There has been considerable debate over the last few years about what the "Top 1%" should be paying in taxes. This of course has come to the forefront of the political debate because of the newly proposed "Buffet Rule." The rule is named as such because Warren Buffett, a fairly sensible billionaire, has publicly and repeatedly stated that he thinks it's absurd that he pays a lower marginal tax rate than this secretary. The reason for this is because the majority of his income is taxed at the capital gains and dividends rate that is capped at 15%. While his secretary has ordinary earned income that is taxed at the progressive and well understood "tax brackets."

It is worth noting that while Buffet's marginal tax rate is lower than this secretary's -- it should not be misunderstood: He DEFINITELY does not pay fewer dollars in taxes than his secretary (in a typical year). It probably also worth noting that he COULD. If he elected to not pay himself any dividends or paychecks, I expect Mr Buffet could pay $0 in income tax any given year if he chose to do so.

Anyway, let look at this more broadly than just one billionaire and his secretary. The chart below shows the distribution of US tax payers by income percentiles, their share of income, and their share of taxes paid.

Chart: Heritage Foundation via Zero Hedge

We can see that the Top 10% of earners, earn 43% of the income and pay 71% of all of the individual income tax. In contrast, the bottom 50% of earners collectively earn on 13% of the income and pay only 2% of all the income tax.

Some may see the tax burden of the Top 10% as unjust, others will see their disproportionate share of the income as even more severe sign of injustice.

Who is paying their "fair share"? The chart above doesn't necessarily give us an answer to that question. It's in part, a moral values question. One possible place to look for answers would be to compare that distribution to other leading OECD countries, or perhaps compare it to past distributions in US history. I think both of those are worth exploring.

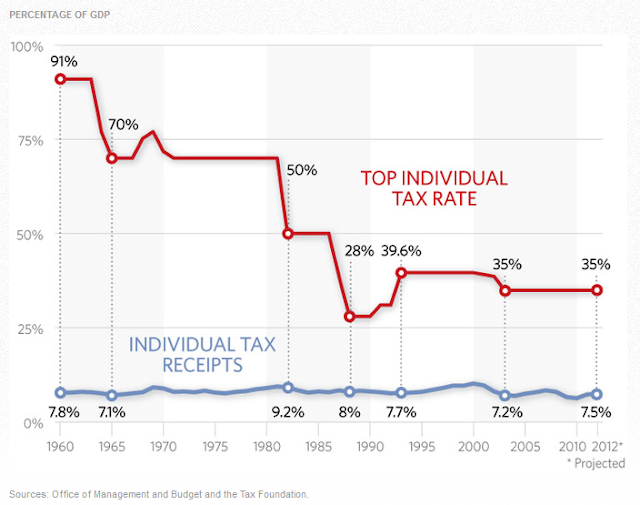

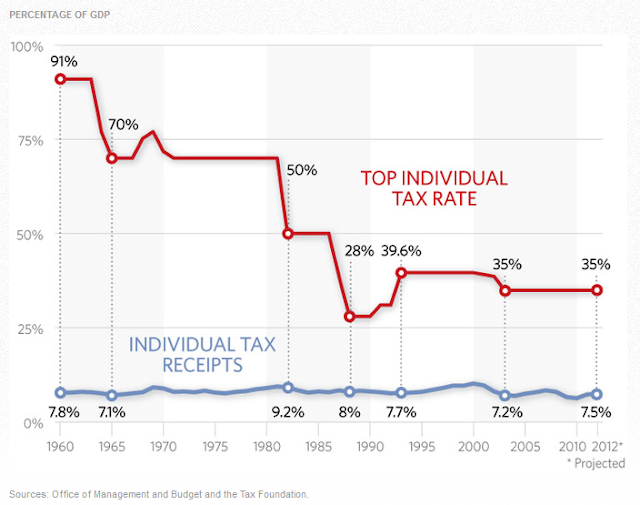

Key to the policy debate is "What should the top marginal tax rate be?" The chart below provides some context to the debate, as the top tax rate has fallen from 91% in 1960 to the mid-30% that we have today. Of course, the top tax rate is a dynamic and vague question.

The top rate needs to be taken into consideration with the brackets, the rate applied to all other brackets, and what types of deductions, credits, and caps are allowed.

This is where the Warren Buffet issue comes into play. He earns in the top tax bracket, but doesn't pay nearly 35% in taxes. He has publicly stated that his effective rate is 15.4%. So it appears that "Top Marginal Tax Rates" don't necessarily effect the top earners nearly as much as we expect. Perhaps professional athletes and movie stars are affected, but all of the hedge fund millionaires and business owners (small and large) have much more control over when and how their income is applied. Often their choices are how and when to realize their income will be driven by tax code. However, I laugh-out-loud at the notion that people will stop trying to get rich if the tax rates on the Top 1% are raised. John Paul Getty wasn't exactly deterred by high taxes -- and he made his billions when the top rate was 90%.

Chart: Heritage Foundation via Zero Hedge

The chart above shows that there is no visible correlation between the top marginal tax rate and the total amount of income tax paid. Of course, as mentioned above, we have no idea what counter balancing factors were going on in the tax code from this chart. All we can say for sure is that it looks like Uncle Sam collects around 8% of GDP each year as tax revenue. So perhaps the answer for increasing revenues (and closing the deficit) is less related to the tax code and more related to raising GDP.

Food for thought in this election year.

It is worth noting that while Buffet's marginal tax rate is lower than this secretary's -- it should not be misunderstood: He DEFINITELY does not pay fewer dollars in taxes than his secretary (in a typical year). It probably also worth noting that he COULD. If he elected to not pay himself any dividends or paychecks, I expect Mr Buffet could pay $0 in income tax any given year if he chose to do so.

Anyway, let look at this more broadly than just one billionaire and his secretary. The chart below shows the distribution of US tax payers by income percentiles, their share of income, and their share of taxes paid.

Chart: Heritage Foundation via Zero Hedge

We can see that the Top 10% of earners, earn 43% of the income and pay 71% of all of the individual income tax. In contrast, the bottom 50% of earners collectively earn on 13% of the income and pay only 2% of all the income tax.

Some may see the tax burden of the Top 10% as unjust, others will see their disproportionate share of the income as even more severe sign of injustice.

Who is paying their "fair share"? The chart above doesn't necessarily give us an answer to that question. It's in part, a moral values question. One possible place to look for answers would be to compare that distribution to other leading OECD countries, or perhaps compare it to past distributions in US history. I think both of those are worth exploring.

Key to the policy debate is "What should the top marginal tax rate be?" The chart below provides some context to the debate, as the top tax rate has fallen from 91% in 1960 to the mid-30% that we have today. Of course, the top tax rate is a dynamic and vague question.

The top rate needs to be taken into consideration with the brackets, the rate applied to all other brackets, and what types of deductions, credits, and caps are allowed.

This is where the Warren Buffet issue comes into play. He earns in the top tax bracket, but doesn't pay nearly 35% in taxes. He has publicly stated that his effective rate is 15.4%. So it appears that "Top Marginal Tax Rates" don't necessarily effect the top earners nearly as much as we expect. Perhaps professional athletes and movie stars are affected, but all of the hedge fund millionaires and business owners (small and large) have much more control over when and how their income is applied. Often their choices are how and when to realize their income will be driven by tax code. However, I laugh-out-loud at the notion that people will stop trying to get rich if the tax rates on the Top 1% are raised. John Paul Getty wasn't exactly deterred by high taxes -- and he made his billions when the top rate was 90%.

Chart: Heritage Foundation via Zero Hedge

The chart above shows that there is no visible correlation between the top marginal tax rate and the total amount of income tax paid. Of course, as mentioned above, we have no idea what counter balancing factors were going on in the tax code from this chart. All we can say for sure is that it looks like Uncle Sam collects around 8% of GDP each year as tax revenue. So perhaps the answer for increasing revenues (and closing the deficit) is less related to the tax code and more related to raising GDP.

Food for thought in this election year.

Labels:

Buffet,

Buffet Rule,

GDP,

taxes,

Top 1%,

top marginal tax rate

Sunday, April 29, 2012

A Bottom for Natural Gas?

Earlier this week, the Market Monkey opened up a long position in Natural Gas.

I don't have any indicators that say "this is the bottom." Mostly there is a lot of evidence that says, "this is cheap." I happened to see natural gas stories popping up in a number of places this week, so it's possible that it will garner some buyer attention here. It came up on my stochastic screens and also there have been a number headlines over the last two weeks about Aubrey McClendon's ongoing irresponsible money management at Chesapeake Energy (CHK). Also, natural gas is on the cover of Fortune Magazine this week.

This chart shows how dramatically natural gas prices (in the US) have fallen in the last four years. From $14 to $2.

It's helpful to put that fall in price in perspective. Crude oil has retained it's value in that same period. So we have seen a parabolic rise in the price ratio between natural gas and crude oil.

To me, this says one important thing: Energy is not as fungible as they say it is on TV.

Certainly, it takes some time to convert infrastructure from using oil to natural gas. Energy stored in one form is not easily transferable to another form. (I am optimistic that battery and fuel cell technology will change this the future). But there are lots of capital-rich and rational-acting trucking companies out there that probably see an economic incentive to start converting engines to natural gas vs diesel fuel. That process is likely to start sooner if the price ratio is 50X.

I think the big beneficiaries of this change are households that use natural gas to heat their homes and steel companies that use natural gas to make steel.

There is another other piece of information that is interesting to about the decline in natural gas prices. Its that the cheap price of natural gas is unique to North America. Prices remain around $10 for natural gas delivery in Europe and Asia. This has to be attributable to the recent productivity gains from shale.

One would think that the the price arbitrage pressures have got to become large enough to overcome the financial and energy costs of natural gas liquefaction. ( I know almost nothing about this... does it need to stay compressed to stay liquid? Does this mean you need to build gigantic compressed tankers to move it from one place to another?) Is 5X a different enough price to get the ball rolling?

In any case -- below $2 seems very cheap for a commodity that was $14 in recent memory. Of course there is not much of a floor here. Natural gas could certainly keep falling, but it seems cheap enough to start thinking about.

MONKEY BUSINESS

Buying: BOIL @ $6.65

Holding: RENN ($5.30), AGQ ($79.85, $63.16, $54.10, $60.35), UGL ($91.00), AVL($2.72), NFLX ($74.70), DAG ($11.00)

Apple's Huge Pile of Cash and a Mountain of Student Debt

It is difficult to find the right words to describe Apple's earnings announcement last week. The largest (by market cap) and most profitable (by net income) company in the world managed to grow like a baby baboon drinking bovine growth hormone.

Year over years earnings growth was 91% higher, total revenue was up 59%.

That is just INCREDIBLE. A company at that scale simply SHOULDN'T be able to grow that fast. Frankly, the Market Monkey can't get his head around it. In it's most recent quarter, Apple's market cap peer, Exxon Mobile (XOM) had earnings growth of 1.6%.

Really, Apple is growing like a teenager. The world's biggest, smartest, and tallest teenager.

This chart was posted on Zero Hedge this week. The scales are a little different with total US student loan debt at about $1 trillion and AAPL's cash hoard at around $109 B. But it's a funny (ha ha) correlation. Is $10 out of every student loan dollar going to pay for Apple products?

Chart: Bloomberg via Zero Hedge

Some back-of-the-credit-card-offer math:

Tuition at a mid-tier public university: $5000 / semester

x 2 Semesters = $10,000 / year

x 4 Years = $40,000

50% Borrowed: $20,000

--------------------------------

Total Student Debt Expense = $20,000

MacBook Pro: $1500

iPhone: $200

iPod Nano: $129

iPad: $400

----------------------------

Total Cash to Apple: $2,229

Cash to Apple : Student Debt Expense = 11%

Apple's Total Cash Hoard : Total Outstanding Student Debt: 11%

Sadly, the math works out. Perhaps the US Department of Education should start negotiating a better bulk discount.

MONKEY BUSINESS

Holding: RENN, ($5.30), AGQ ($79.85, $63.16, $54.10, $60.35), UGL ($91.00), AVL($2.72), NFLX ($74.70), DAG ($11.00)

Thursday, February 2, 2012

RenRen as Alternative to Facebook (RENN vs FACE)

vs

With all the news about the upcoming Facebook IPO, many people are wondering if they should take the opportunity to buy Facebook once it starts trading.

My thought is that the underwriters know that this will be one of the most closely watched IPOs of the decade, so expect that the IPO will be under priced. There will almost certainly be a meaningful pop of 25% or more on the first day. So, if you are fortunate enough to get in on the IPO, then it's probably best that you do so. Of course, under pricing the stock is bad for the company. But they are selling $5 B worth of stock that day, so perhaps that will be enough cash.

As a closing thought, for Facebook to be worth the same as Google ($190 B), it needs to double from the IPO. That means it needs to create $100 B worth of value, which is not easy. For RenRen (RENN) to double, it only needs to create $2 B of value. That seems a lot easier to do when you have a $100 B big brother to follow and a powerful Chinese government that would rather have you succeed than your big brother.

With all the news about the upcoming Facebook IPO, many people are wondering if they should take the opportunity to buy Facebook once it starts trading.

My thought is that the underwriters know that this will be one of the most closely watched IPOs of the decade, so expect that the IPO will be under priced. There will almost certainly be a meaningful pop of 25% or more on the first day. So, if you are fortunate enough to get in on the IPO, then it's probably best that you do so. Of course, under pricing the stock is bad for the company. But they are selling $5 B worth of stock that day, so perhaps that will be enough cash.

Since we have no idea where the stock will trade after it floats, it's difficult to make an opinion based on valuation. The next reports are suggesting something in the range of $75 to $100. So for the sake of thought, let's assume it prices the night before at $80 B and then has an immediate 25% pop and starts trading at $100 B.

Obviously FB is behemoth of a company. $100 B given it's market power today seems reasonable. Currently Google is worth $198 B, but unlike FB they have massive amounts of revenue and profit to back that up that valuation. They trade at about 5X revenue and 20X earnings. At a valuation of $100B, Facebook would be trading around 60X revenue is which is VERY steep. 10X revenue was considered "rich" even in the dotcom bubble. What is attractive about FB is that is have undeniable stickiness, and it currently is the #1 most visited site in the US. Importantly, it also has a very long average visit time compared to the other top sites. The network effect of Facebook's market share is very compelling -- and it's hard to construct a scenario where users start leaving Facebook in mass. So from that point of view, the is the moat around the business is VERY wide -- and in that way it is much more like Microsoft or Google than Groupon or Netscape.

In the end, it's just that fact that the valuation is so high already that it difficult to get really excited about it. At $100B, it doesn't have a lot of room to grow -- it would be around the 25th most valuable company in America. It's peer companies (in terms of market cap) would be Cisco, Pepsi, McDonald's. If you are looking to double your money, then FB would have to grow to the 7th (or so) largest company, surpassing the likes of Proctor & Gamble, AT&T, and GE to get there.

In the end, it's just that fact that the valuation is so high already that it difficult to get really excited about it. At $100B, it doesn't have a lot of room to grow -- it would be around the 25th most valuable company in America. It's peer companies (in terms of market cap) would be Cisco, Pepsi, McDonald's. If you are looking to double your money, then FB would have to grow to the 7th (or so) largest company, surpassing the likes of Proctor & Gamble, AT&T, and GE to get there.

So, I went searching for a cheaper alternative. I've decided to play the Facebook IPO through Renren (RENN). The "Chinese Facebook" it doesn't have the same market dominance that FB has. Even in China, it is only the 2nd or 3rd most popular social networking site. But with 120 million users (and growing) it has a real opportunity to truly become the "Facebook of China." It is clearly copying them in many ways. At $2B (23X revenue), the valuation is still high, but much easier to swallow. As a follower of FB, is has the luxury of just replicating the way Facebook creates user experiences and generates revenue. The reports that I read suggest that RENN is making excellent gains in Chinese market share. However, I don't know how reliable any of that data is.

In addition to being a cheaper stock with more potential for growth, RENN might be an acquisition target for Facebook. Facebook has a tiny, tiny, tiny share of market in China. A few billion to jump to the top of the list -- buying a site that has essentially a Chinese knock-off of the Facebook user interface might be an easy decision for a CFO that has $100 B of FB equity to trade with.

Also, RENN has performed terribly since it's IPO, so the hype has already faded from that star and is ripe for some attention. The Facebook IPO might be the catalyst to bring that to the front of mind for both retail and institutional investors.

MONKEY BUSINESS

Buying: RENN @ $5.30

Holding: AGQ ($79.85, $63.16, $54.10, $60.35), UGL ($91.00), AVL($2.72), NFLX ($74.70), DAG ($11.00)

Subscribe to:

Posts (Atom)